Budgeting for Families is a crucial aspect of financial well-being, helping families achieve stability and reach their goals. From creating a budget to managing debt, this guide covers all you need to know in a cool and relatable high school style.

Importance of Budgeting for Families

Budgeting is crucial for families as it helps them manage their finances effectively, plan for the future, and achieve their financial goals. By creating a budget, families can track their income, expenses, and savings, ensuring that they are living within their means and saving for emergencies or long-term goals.

Benefits of Budgeting for Families

- Provides financial stability: Budgeting allows families to have a clear picture of their financial situation and helps them avoid overspending.

- Helps in goal setting: By budgeting, families can set specific financial goals such as saving for a house, education, retirement, or a vacation.

- Reduces financial stress: Knowing where your money is going and having a plan in place can reduce anxiety and stress related to money.

- Encourages smart spending: Budgeting helps families prioritize their spending on essentials and cut back on unnecessary expenses.

How Budgeting Can Help Families Achieve Financial Goals

- Identify areas for savings: By tracking expenses, families can identify areas where they can cut back and save more for their financial goals.

- Build an emergency fund: Budgeting helps families set aside money for emergencies, ensuring they are prepared for unexpected expenses.

- Track progress: With a budget in place, families can monitor their progress towards their financial goals and make adjustments as needed.

Creating a Family Budget

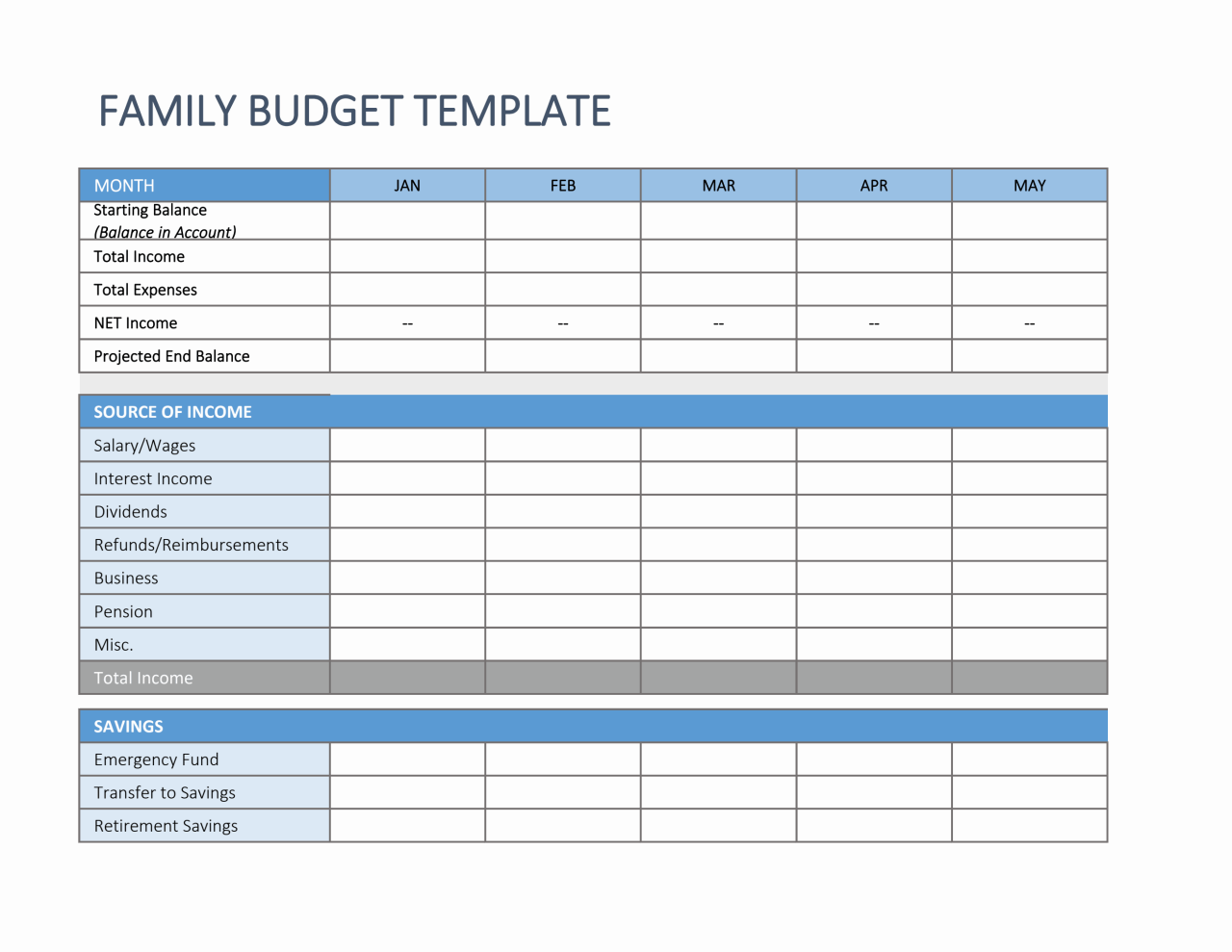

Creating a family budget is crucial for financial stability and ensuring that all expenses are covered. Here are some steps to help you create an effective family budget:

Step 1: Calculate Your Income

- List down all sources of income for your family, including salaries, bonuses, and any other additional income.

- Ensure to include any irregular income like freelance work or side gigs.

Step 2: Track Your Expenses

- Record all your expenses for at least one month to get a clear understanding of where your money is going.

- Categorize your expenses into fixed (mortgage, utilities) and variable (groceries, entertainment).

Step 3: Set Financial Goals, Budgeting for Families

- Determine short-term and long-term financial goals for your family, such as saving for a vacation or college fund.

- Allocate a portion of your income towards these goals in your budget.

Step 4: Create a Budget Plan

- Use a budgeting method that works best for your family, such as the 50/30/20 rule (50% for needs, 30% for wants, 20% for savings) or the zero-based budgeting method.

- Make sure your budget plan is realistic and flexible to accommodate unexpected expenses.

Involving Family Members

To ensure the success of your family budget, it’s important to involve all family members in the process. Here are some tips to get everyone on board:

- Hold regular family budget meetings to discuss financial goals and progress.

- Assign responsibilities to each family member, such as tracking expenses or finding ways to save money.

- Encourage open communication about financial decisions and encourage children to participate in age-appropriate budgeting activities.

Tracking Expenses: Budgeting For Families

Tracking expenses is a crucial aspect of family budgeting as it allows families to monitor where their money is going, identify spending patterns, and make informed financial decisions.

The Importance of Expense Tracking

Effectively tracking expenses helps families stay within their budget, avoid overspending, and save money for future goals. It provides a clear picture of financial habits and areas where adjustments can be made.

Tools and Apps for Expense Tracking

There are various tools and apps available to help families track their expenses efficiently. Some popular options include:

- Mint: An all-in-one financial tracking app that categorizes expenses, sets budgets, and provides alerts for upcoming bills.

- YNAB (You Need a Budget): Focuses on giving every dollar a job, helps in tracking spending, and encourages proactive budgeting.

- PocketGuard: Syncs all financial accounts, categorizes expenses, and offers insights on where money is being spent.

Categorizing and Analyzing Expenses

When categorizing expenses, it’s essential to group them into specific categories such as housing, transportation, groceries, utilities, entertainment, and savings. Analyzing expenses involves reviewing spending trends, identifying unnecessary expenses, and prioritizing essential needs over wants.

Saving Strategies for Families

When it comes to saving money effectively, families can implement various strategies to secure their financial future. By being proactive and disciplined, families can build a solid financial foundation that can withstand unexpected expenses and emergencies.

Building an Emergency Fund

One crucial saving strategy for families is to establish an emergency fund. This fund should ideally cover three to six months’ worth of living expenses and should be easily accessible in case of unexpected events such as medical emergencies, car repairs, or job loss.

- Set a monthly savings goal: Allocate a portion of your income each month towards building your emergency fund. Treat this savings goal as a non-negotiable expense.

- Automate your savings: Set up automatic transfers from your checking account to your emergency fund to ensure consistent contributions without the temptation to spend elsewhere.

- Keep the fund separate: Store your emergency fund in a separate account, such as a high-yield savings account, to prevent easy access for non-emergency spending.

Long-Term Savings Goals

Aside from emergency funds, families can also set long-term savings goals to achieve financial milestones and secure their future.

- Saving for retirement: Allocate a portion of your income towards retirement savings accounts such as 401(k) or IRAs to ensure financial stability during your later years.

- Education funds: Start saving for your children’s education early by setting up a college fund or other educational savings account to alleviate the burden of student loans in the future.

- Homeownership: Saving for a down payment on a house can be a long-term goal for families looking to invest in property and secure stable housing for the future.

Managing Debt within Family Budgets

Debt can be a major obstacle for families trying to stick to a budget and achieve financial goals. Here are some strategies to help families manage and reduce debt effectively.

Creating a Debt Repayment Plan

- Start by listing out all debts, including credit cards, loans, and mortgages.

- Organize debts from the highest interest rate to the lowest to prioritize repayment.

- Allocate a specific amount from the family budget towards debt repayment each month.

Utilizing Debt Snowball or Debt Avalanche Methods

- In the debt snowball method, focus on paying off the smallest debt first while making minimum payments on others.

- With the debt avalanche method, prioritize paying off the debt with the highest interest rate first.

- Continue this cycle until all debts are paid off, gradually increasing the amount allocated towards debt repayment.

Impact of Debt on Family Finances

- High levels of debt can lead to increased stress and financial strain within the family.

- Interest payments on debts can eat into the family budget, limiting resources for other essential expenses.

- Defaulting on debt payments can negatively impact credit scores, making it harder to secure loans in the future.

Avoiding Debt Traps

- Avoid taking on new debt unless absolutely necessary, focusing on living within means.

- Be cautious of high-interest loans or credit cards that can lead to a debt cycle.

- Build an emergency fund to cover unexpected expenses and reduce the need for borrowing in times of crisis.